How Revenue-Based Financing Supports Venture Capital

Revenue-Based Financing & Venture Capital

What is Revenue-Based Financing?

Revenue-based financing is an alternative form of financing where companies pay a percentage of their future monthly revenue in exchange for growth capital. This form of financing is best suited for companies that are post-revenue, have established customers, a scalable cost structure, and a clear path to profitability. RBF is typically used to fund growth initiatives, such as sales team expansion or to increase marketing spend.

Companies have looked to revenue-based financing as a complement to equity financing. How exactly does revenue-based financing support venture capital? Founders are able to further fuel the growth of their company by extending cash runway and increasing their company valuations prior or following an equity round. Let’s take a deeper look.

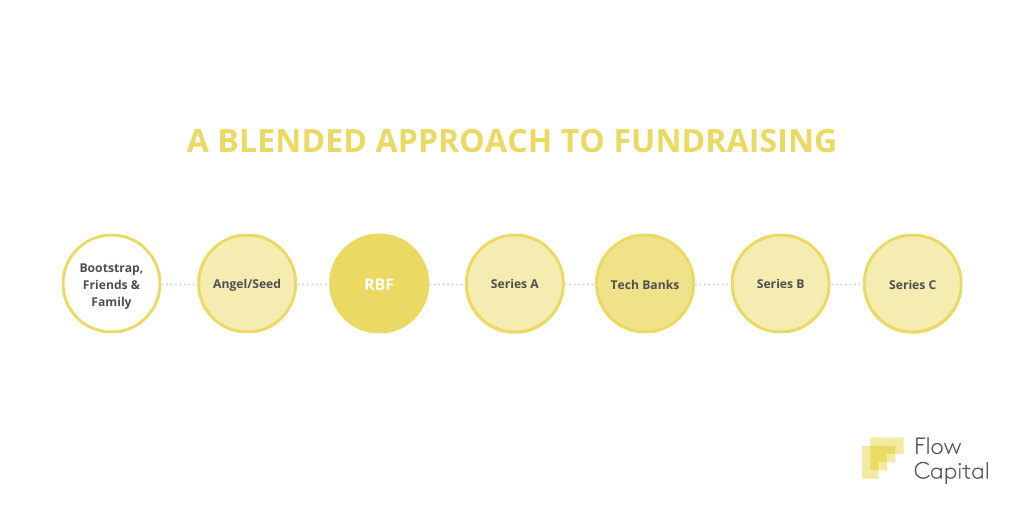

Where Does RBF Fit In?

Revenue-based financing often sits between an angel or seed round and venture capital financing, but can be used at any point in time as long as the company is post-revenue and is experiencing steady or rapid growth.

Revenue-Based Financing Pre-VC

Minimize Equity Dilution

One of the main reasons founders look to RBF is because it is minimally-dilutive. Founders are able to grow their companies without selling an equity stake to the RBF investor. Instead, the company only pays a percentage of their future monthly revenue. If the company successfully grows, this is a much lower cost of capital than equity.

Increase Your Company’s Valuation

A valuation determines the economic value of a business or company, which depends on a variety of factors including industry, sector, valuation method, and economic conditions. In order for a company to be valued, VCs typically use financial statements, cash flow models, and market analysis. RBF can help boost your company’s financial performance by funding the growth initiatives needed to secure recurring or consistent revenue. Leveraging RBF prior to a VC round can significantly increase your company’s valuation.

Attract VC’s

Attracting VCs can be difficult. Revenue-based financing can provide companies a solid foundation to grow rapidly in a way that attracts interest. Potential VC partners are looking for a solid growing flow of sales and the ability for the company to reach inflection points in the market. Once the company is ready for VC funding, they will be able to turn that traction into market leadership.

Revenue-Based Financing Post-VC

Qualify for RBF

While RBF is designed for companies that are in the startup/growth stage, it is not for brand-new businesses. Early-stage startups with less than a year of operating history and/or are pre-revenue will not be able to qualify for RBF. Venture capital can provide a company with the initial funds needed to grow the business. Once the company has a year or two of monthly revenue under their belt, they can begin looking for RBF providers.

Extend Cash Runway

Companies may decide to extend their cash runway for multiple strategic reasons. For one, a cash runway insures yourself against potential pivots, cost overruns, or lumpy revenues associated with seasonal businesses. It also provides you with comfortable lead time for fundraising to help you reach significant milestones to scale your business. How much runway does your company need? While the specific number depends on the type of company, investors recommend you cushion your business anywhere from 18-24 months between funding rounds.

For post-VC companies, a faster than expected burn rate or unexpected expenses may shorten this runway. This is where revenue-based financing comes in. Instead of securing a bridge round, founders can leverage RBF to get the growth capital they need without diluting more equity.

Summary

Venture capital alone can be an extremely expensive cost of capital, especially if the company becomes successful. Revenue-based financing, whether used pre or post-VC, allows founders to access the growth capital they need while minimizing equity dilution.

Ready for Revenue-Based Financing?

Flow Capital provides founder-friendly growth capital through revenue-based financing. Over the last few years, the company has deployed over $80M in growth capital to over 46 companies. Investments range between $500K and $4M and are reserved for high-growth companies generating at least $1 million in annual revenue.

Ready to grow? Apply here.