Copyright 2024 Flow Capital Corp. All rights reserved

FLOW CAPITAL

THE FOUNDER’S GUIDE TO VENTURE DEBT

Venture Debt

Fund Growth While Minimizing Equity Dilution

Also known as venture lending, venture debt is an attractive financing option for early and growth-stage companies. This form of alternative debt generally consists of a term loan lasting up to three years with warrants on company stocks.

Table of Contents

What is Venture Debt?

Also known as venture lending, venture debt is a form of minimally dilutive debt financing used by high-growth companies. While the exact structure of a venture debt loan can vary, it is typically structured as a term loan with interest payments and warrants.

Venture debt is available to both non-venture capital and venture capital-backed companies as it can be used as both a complement or alternative to equity financing. The ultimate goal is venture debt is to provide businesses the growth capital they need to reach their business goals and at the same time, allowing founders to maintain control and minimize equity dilution.

When to Raise Venture Debt

A general rule of thumb when raising debt is to raise it when you don’t need it. Venture debt is often raised alongside or soon after an equity round. Although some lenders, like Flow Capital, provide venture debt to non-venture-backed companies, creditworthiness and bargaining power are generally highest immediately after closing a round of equity. During this period, verifying a company’s valuation is also easier since the venture capital investors had just completed considerable due diligence with the most updated corporate information available.

When Not to Raise Venture Debt

If You Can’t Repay

If you don’t think your company can repay the interest payments, you should not raise venture debt. Signs your company may not be ready also include:

- Performing poorly

- Lacking momentum

- Has a high burn rate

- Has a highly variable revenue stream

- Has less than six months of cash, or

- Is considering debt as a last resort for funding

You should only raise venture debt if you know your company has sufficient cash flow to service the debt or if you are confident you can raise another round of equity in the future to repay the loan.

If the Terms or Covenants Are Too Heavy

Before agreeing to a venture debt loan, you should have someone on your team model the cost of the debt and understand the impact of any covenants on the company. From there, you can get a sense of the company’s financial position if it were to raise a round of venture debt.

If Your Investors Are Not Supportive

Although venture debt is a great option for venture capital investors to use within their portfolio companies to reduce dilution, you should avoid raising it if you do not have the approval of your existing investors or board.

Benefits of Venture Debt

Raising venture debt can provide high-growth companies two main benefits:

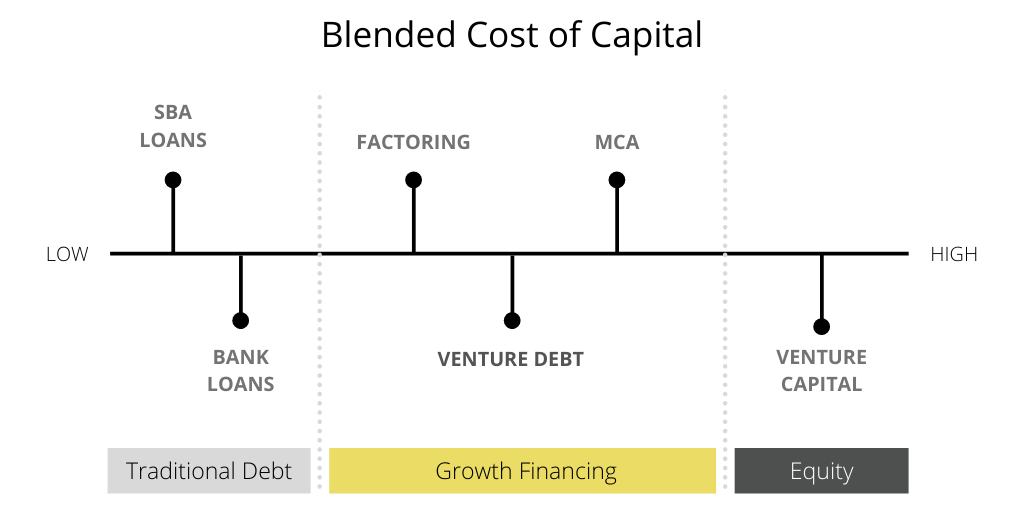

Venture Debt Can Reduce the Average Cost of Capital

The first benefit is venture debt can reduce the average cost of capital by offering minimally dilutive funding to rapidly scaling companies. This is especially true when raising venture debt alongside an equity round since equity is the most expensive form of growth capital due to its highly dilutive nature.

Venture Debt Provides Flexibility

The second benefit is venture debt provides flexibility. Not only does venture debt not require board seats, but the loan itself can be used as a cash cushion in case the company experiences any hiccups along the way. This is a material difference from senior-secured lending, for example, which typically requires that a specific underlying asset is financed. and pledged as a security and/or requires personal guarantees.

Learning Checkpoint #1: Reducing the Average Cost of Capital with Venture Debt

Company A wants to raise $12 million in order to achieve its next growth milestones – expanding its product line and investing in sales and marketing. The company successfully raises $10 million from a venture capital firm at a $50 million valuation for 20% equity.

What should Company A do about the remaining $2 million?

Option 1: Raise More Equity

The first option on the table is to raise an additional $2 million from venture capital investors at the same valuation of $50 million. By doing so, however, they give up an additional 4% in equity.

Option 2: Raise Venture Debt

The second option is to raise venture debt with a 10% warrant coverage*. This equals $200,000 worth of company stock or 0.4% in equity.

Conclusion

As you can see, raising $2 million in venture debt with 10% warrant coverage results in 0.4% of potential equity dilution as opposed to 4% of equity dilution if they were to raise additional venture capital. In this situation, it could be in the company’s best interest to raise venture debt instead of venture capital.

*For more information about warrants, read our Founder’s Guide to Warrants in Venture Debt.

Uses of Venture Debt

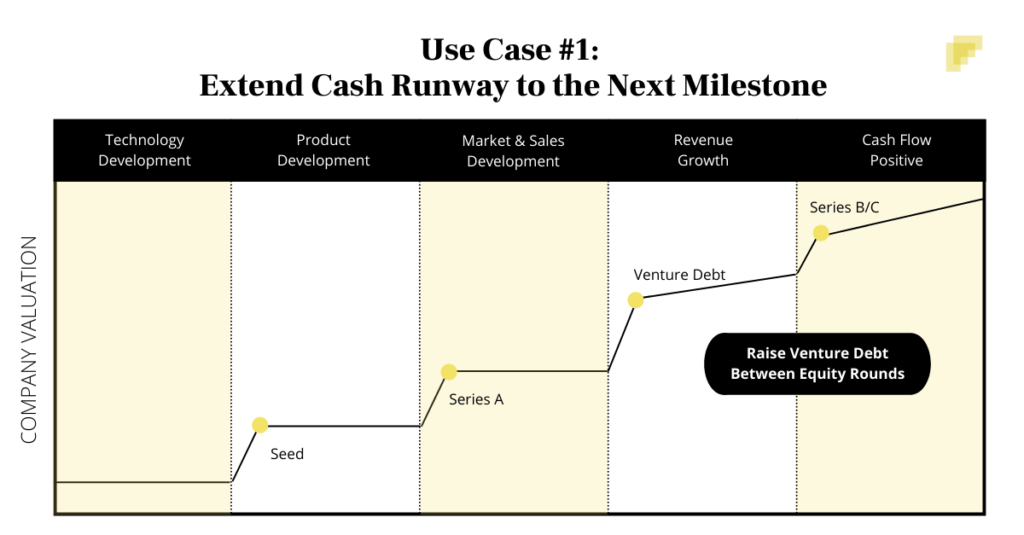

Extending Cash Runway to the Next Milestone

Venture debt provides a variety of use cases, but one of the most popular uses is to extend cash runway to reach the company’s next milestone. Consider the image above. Let’s say the company wants to reach a certain level of revenue before raising their Series B in order to optimize. the company’s valuation. A small injection of minimally dilutive venture debt is often a great way to extend their current cash position until this milestone is achieved rather than raising at a lower-than-desired valuation.

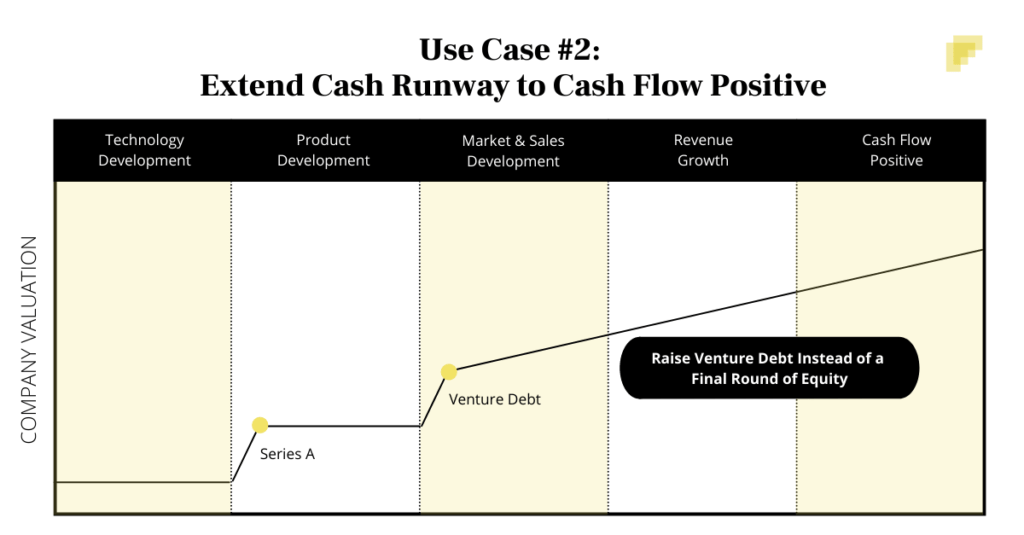

Extend Cash Runway to Cash Flow Positive

The second use case is for companies on the cusp of reaching breakeven. Venture debt can propel that company forward during a critical period of growth. It may even eliminate the need for a subsequent or final round of equity altogether.

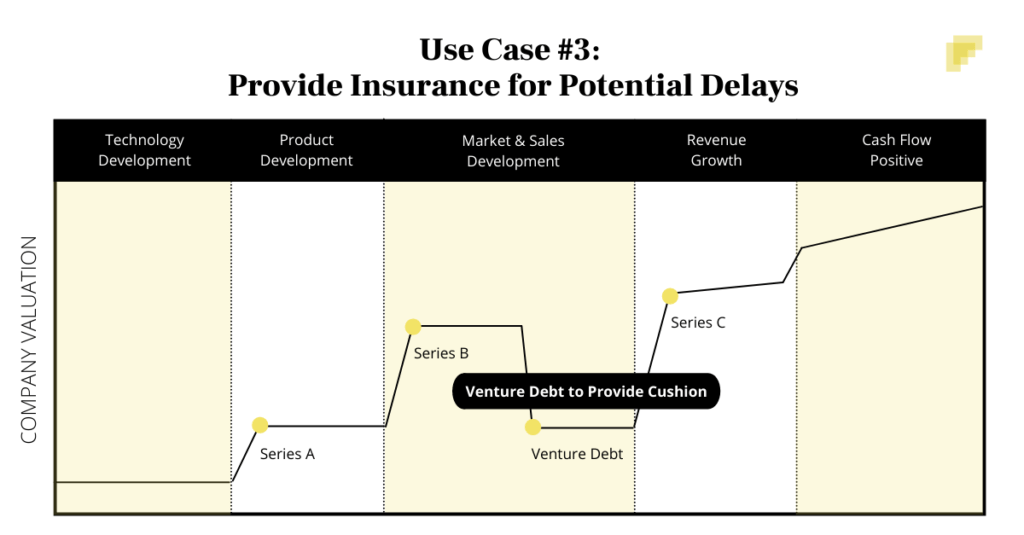

Provide Insurance for Potential Delays

The third most important use for venture debt is it can also serve as an insurance policy by providing an extra cushion of cash in case a key phase of the lifecycle takes longer than expected. An injection of venture debt allows the company to reach its next milestone and avoid raising a “down round,” something every founder should seek to avoid.

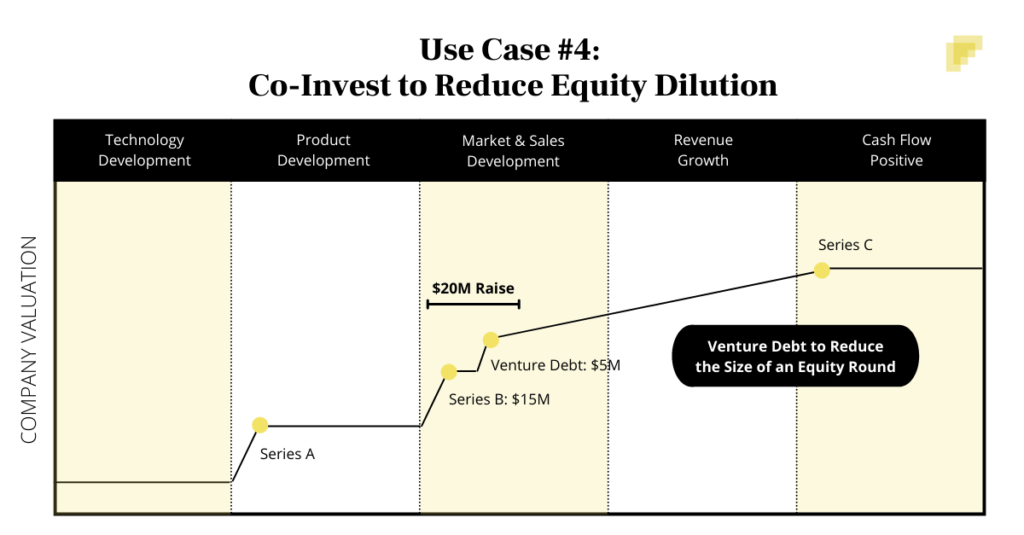

Co-Invest to Reduce Equity Dilution

The fourth use case for venture debt is to raise it alongside a round of equity in order to reduce equity dilution. Let’s take an example from the chart above. Company A is in its Market & Sales Development stage and is looking to raise $20 million. Instead of raising the full $20 million through a Series B, the company decides to only raise $15 million through venture capital investors and raise the remaining $5 million in venture debt. Because venture debt relies on interest payments and modest warrant coverage, the company is able to reduce equity dilution.

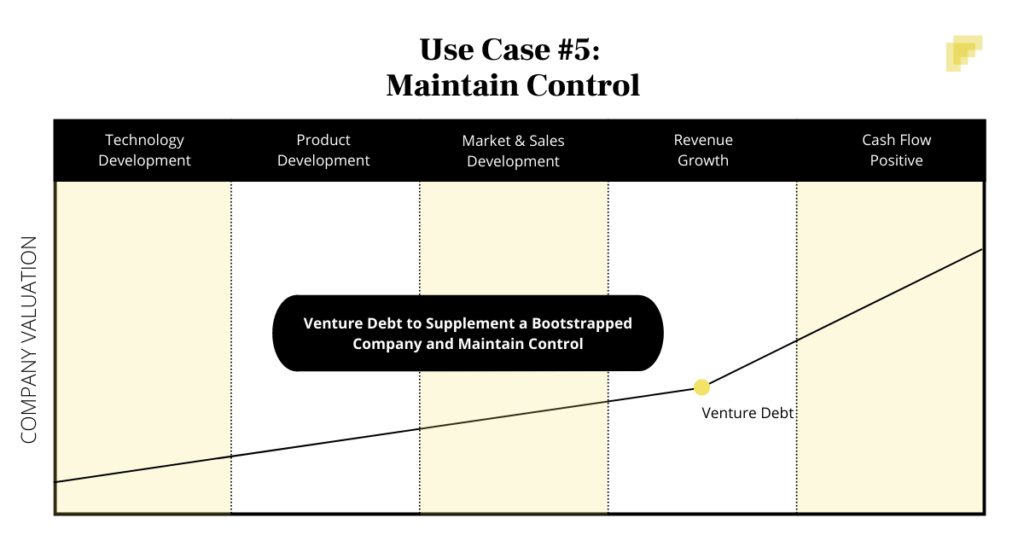

Maintain Control

Another use case for venture debt is for founders seeking to maintain control over their companies. The equity financing business model is predicated on liquidity. Equity investors invest based on the goal of companies being acquired or going public within a relatively short time period. As a result, founders are subject to forced liquidity timelines, which is a problem of the VC model from an entrepreneur’s perspective. Other factors that feed into loss of control include board seat requirements, shareholder agreement requirements, etc. By taking venture debt, founders can avoid some of the downsides and challenges of taking venture capital as part of their capital profile.

The chart above demonstrates the growth of a bootstrapped company – a company with little or no outside capital. The company has been able to grow organically from its technology development stage to the revenue growth stage. In order to supercharge this growth, they decide to raise venture debt which allows the company to raise growth capital without giving up control through board seats, without personal guarantees, and while minimizing equity dilution.

The Cost of Venture Debt

The average cost of venture debt from a venture debt lender typically ranges between 12-15%.

These interest rates are a reflection of the level of risk lenders are engaging in and the flexibility they are providing. Venture debt is often used by companies who do not qualify or do not want bank debt due to their riskier nature. For example, a software company may not qualify for bank debt because they have a lower amount of hard assets (e.g. no equipment, no buildings, etc.) – so the bank has limited assets to secure their loan to. Early-stage companies have a hard time qualifying for bank debt because they are smaller and are still generating lower levels of revenue. Venture debt is available to these “riskier” companies, and therefore, comes with a higher cost of capital.

Additionally, venture debt also comes with less restrictive clauses, which is a reflection of the flexibility required in higher-risk situations and the inability of some companies to meet restrictive clauses such as cash flow covenants. As a result, venture debt providers use higher interest rates and modest warrant coverage to increase their potential returns for the additional risk they are taking on.

Compared to Bank Debt

The cheapest form of financing a company can take is senior-secured bank debt. Bank debt is typically reserved for companies perceived as “less risky.” Lower risk is often associated with larger companies, higher levels of revenue, profitability, and higher asset-backed coverage. In order to lower their risk exposure even more, banks also use strict financial covenants. Because banks engage in low-risk deals, bank debt interest typically ranges in the single digits.

Compared to Equity

Equity financing is the most expensive form of growth capital. Angel and venture capital firms invest when the stage of development of a company is higher risk (e.g. technology development, product development, market and sales development, revenue growth).

The Fundraising Process for Venture Debt

How Long Does It Take to Raise Venture Debt?

Raising venture debt is a much faster process than traditional fundraising methods. While the timeline largely depends on the length of the due diligence process, the entire process typically ranges anywhere from 4-8 weeks.

The Fundraising Process

The venture debt fundraising process is usually broken down into six main steps:

- Origination

- Initial Screening

- Term Sheet

- Due Diligence

- Legal Documentation

- Funding

#1 – Origination:

Origination involves the sourcing of venture debt opportunities. Companies can seek referrals through their VC investors. Otherwise, most venture debt lenders provide online applications or contact information directly on their websites.

#2: Initial Screening:

The next step of the process is the initial screening. This usually takes place over a call between the lender and the founder, CEO, or CFO of the company. Prior to this stage, you should be ready to provide a company pitch/investor deck, historical financials (trailing twelve months), and a pro forma financial model. During the call, the lender will learn more about your company, your specific needs, your plans for growth, and to address any questions you have about the financing structures. The goal of the call is to determine if there is a good fit for both parties prior to executing a term sheet and launching into full due diligence.

#3: Term Sheet

Once both parties have determined there is a good fit, the lender will issue you a term sheet. A term sheet is a non-binding document that is designed to provide you as the company with a basic set of conditions to give you an idea of what terms to expect once the full due diligence process is complete. Companies can and should negotiate during this stage.

#4: Due Diligence

Once negotiations have ended and the term sheet is signed, the venture debt lender will go into the full due diligence process. This process can take anywhere from 3-6 weeks but can extend longer depending on the materials the company has ready and available. Due diligence involves digging into historical financials, financial projections, the company’s current cap table, and management team. Other steps may include things such as site visits and customer/client calls to better understand how the company is perceived in the market by key stakeholders.

The aim of the venture debt process is to gain insight into the following key questions:

- Is there a strong management team?

- Is there strong revenue and cash flow?

- Are there positive unit economics?

- Is there a clear path to profitability?

- What is the market opportunity?

Warrants in Venture Debt

What are Warrants?

A classic feature in venture debt deals is warrants, which provide venture debt lenders the right, but not the obligation, to buy common shares of a company at a fixed price within a certain period of time. Expiration dates can range anywhere from 1 to 15 years.

Why Are Warrants Used?

Warrants are used in venture debt deals to further attract lenders. This “sweetener” is attractive because it enables additional participation in the company’s growth.

Average Warrant Coverage on Venture Debt Deals

Because warrants are a function of the risk/return profile the lender is taking, you will often see double-digit interest rates, double-digit warrant coverage, and less restrictive clauses. The interest rate, terms, and warrant coverage are combined to commensurate with the risk implied in the venture debt investment.

The average warrant coverage on venture debt deals only translates to ~1-2% of the company – if the lender decides to exercise them. This is significantly lower than the dilution associated with venture capital financing.

Benefits of Warrants in Venture Debt

Warrants can offer a range of benefits for both the lender and the company.

For Lenders:

- Additional participation in the company’s growth

- Potential increase in returns

- No upfront costs

For Companies:

- Fair pricing (usually priced at the value of equity at the time of issuance)

- Future cash flow

Disadvantages of Warrants in Venture Debt

For Lenders:

- Finite life (lenders must decide to exercise warrants before the expiration date)

- The value of the warrants can fall to zero once exercised

- No control rights

- Do not receive dividends

For Companies:

- Potential equity dilution in the future (1-2%)

- Shares may be purchased at a discount if the equity value is dramatically higher than the strike price of the warrant

Read our Guide to Warrants in Venture Debt.

How to Negotiate Venture Debt

As mentioned previously, negotiations should occur prior to signing the term sheet. Here are some items in the term sheet you may consider negotiating:

Principal Amount

Sometimes loans are needed to solve immediate cash needs, while other times the capital provides a support cushion. Before agreeing to a principal amount, be sure to take into careful consideration how much money you need, when you need the money, and most importantly, how much your cash flow will be able to support.

Payment Schedule

Venture debt is typically structured as a term loan involving interest payments and principal repayment over a fixed period of time. To delay paying back the principal, you can try negotiating an interest-only period.

Cost of Capital

Lenders may charge additional fees and expenses, such as legal fees, commitment fees, final payment fees, or pre-payment fees. In case cash is tight, you could consider negotiating these amounts.

Covenants

Covenants are a list of do’s and don’ts lenders give while you owe them money.

Do’s: List of compliance requirements (e.g. delivery of financial information, maintenance of insurance coverage)

Don’ts: List similar in scope to the veto rights demanded by equity investors

Default Events

‘Default’ status may be declared based on a list of events constituting a default. These will almost always include failure to make payments on time. However, the exact circumstances are subject to negotiation and should be discussed prior to signing the agreement.

What Happens If I Can’t Repay the Loan?

Repayment

Pay back the loan using the cash on your balance sheet or equity from investors.

Refinancing

Find another lender who is willing to refinance the loan. This involves giving you a new loan to repay the existing loan.

Restructuring

Try negotiating a more favorable repayment plan with the lender. If you are unable to raise equity or refinance, your company will be at risk of default.

Although venture lenders do have the right to foreclose and sell off your company’s assets, they will try avoiding this by working with you and your investors to restructure the loan to provide more flexibility. It is in times like these where choosing the right lender is key. You want to choose a lender who is able to work with founders in a constructive way during tough times.

Choosing a Venture Debt Lender

Positive References

Prior to selecting a venture debt lender, you can try reaching out to current and past portfolio companies to understand how each lender acts during the good, the bad, and the ugly.

Competitive Terms

Companies should aim to get the best terms they can get from the best lender.

Timely and Dependable Funding

Entrepreneurs should be focused on growing their businesses and adapting to customer needs. Taking the time to select a lender who has a strong reputation of funding on time and per the agreed-upon terms can relieve unnecessary distraction from your company’s development.

Partner Mentality

Commitment doesn’t end when the term sheet is signed and the transaction is closed. Select a lender that will be a good financial partner over the duration of the loan.

How to Apply for Venture Debt

Pitch Deck

Creating a clear and concise pitch deck will provide venture debt lenders an overview of where your company is and where you want it to be. Make sure to showcase existing traction through post-product-market fit.

Historical Financial Statements

Since venture debt lenders focus on post-revenue companies, your income statement, balance sheet, and cash flow statement are important resources lenders will look through to gain insight into your company’s traction.

Pro Forma Model

Finally, lenders will be looking for a pro forma model, which shows the financial projections for a specific period of time. These projections are based on hypothetical scenarios. For example, “what would my income, account balances, and cash flow look like with a $1 million loan?”

Read more about the 3 Documents You Need to Apply for Venture Debt.