Copyright 2024 Flow Capital Corp. All rights reserved

FLOW CAPITAL

THE FOUNDER’S GUIDE TO EQUITY DILUTION

Table of Contents

Equity dilution often seems like the only path for new founders – especially if they don’t have a lot to invest upfront.

While it can be a good way to get cash for growth, it’s not always the best route to take. In fact, many founders don’t fully understand the implications of raising dilutive capital or they want to avoid equity dilution completely but aren’t aware of their options.

So what are the pros and cons of equity dilution and how can founders raise minimally-dilutive capital in other ways?

What is Equity Dilution?

Equity dilution occurs when a founder’s ownership stake is reduced as a result of the issuance of new shares, often following an investment. For example, a founder of a new SaaS company might sign over 20% of the company in shares in exchange for investment from an angel investor.

Often, founders will offer equity or shares to their employees to start fundraising efforts and then move on to making an initial public offering (IPO) or attracting other investors by sharing part of the company with them.

Equity dilution is incredibly common in the startup world because most founders don’t have a lot of money to start with.

Once they’ve validated their product and are ready to take it to market, they urgently need a cash injection to scale and grow. One of the easiest ways to do this is to give away equity in the company in exchange for investments.

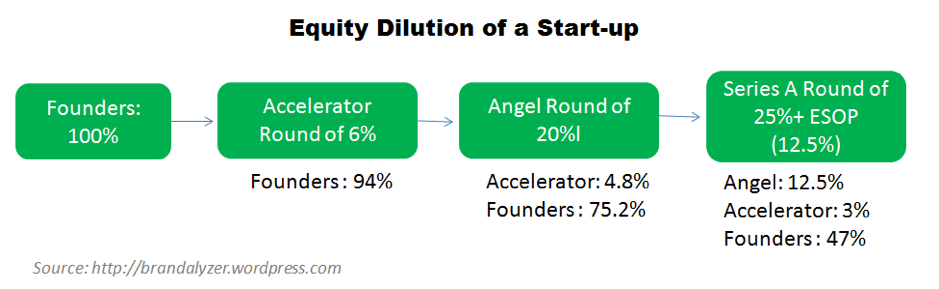

After multiple rounds of funding, equity dilution can look something like this:

Investors see the benefits in this method because they know full well that a startup company likely doesn’t have the funds to pay them back directly. Instead, they’re happy to take on a percentage of the company in the hope that it will bring in more revenue in the future.

How Does Equity Get Diluted?

At its core, company ownership is broken down by shares. When a new company is formed, founders will typically own 100% of their company’s shares. Let’s say in this example, that is 100 shares.

When the founders raise capital, equity is given to investors. The founders still own the same number of shares (100), but 50 shares have been added to the overall pool. This introduction of new shares decreases the founders’ ownership stakes from 100% (100 shares/100 total shares) to 66% (100 shares/150 total shares).

If more capital is raised and after enough equity dilution, the founders’ ownership stakes may be reduced to less than 50%. At that point, the founders risk losing control of the company’s direction and voting power. This is why many founders want to protect themselves against dilution.

When Does Equity Dilution Occur?

There are three common scenarios in which a founder may be subject to equity dilution:

- Fundraising

- Convertible Debt

- Stock Options

Fundraising

When new capital is raised, equity is often given to the investor as their source of return.

Convertible Debt

Convertible debt is a debt structure that allows the principal and accrued interest to convert into an equity investment at a later date. A trigger event, such as an exit or fundraising round, causes debt holders to be converted into shareholders. As a result, the ownership stake held by the initial shareholders is diluted.

Stock Options

Stock options do not result in the issuance of new shares immediately. Instead, they imply that someone will become an equity holder in the future once the options are exercised.

Is Equity Dilution a Bad Thing?

Equity dilution isn’t necessarily a bad thing, but it does come with its fair share of pros and cons.

The Pros of Equity Dilution

- Founders get the capital they need to take their business to the next level

- It’s largely harmless when handled correctly

- Even if a founder’s equity is lowered considerably, they are still likely to earn more than they would without investment

- Investors are committed to the growth of the company

The Cons of Equity Dilution

- Founders have to give up some of the ownership of their company

- Founders lose some control over the future of their business

- There are other ways for founders to secure investment without giving away part of the ownership

Understanding the Value of Your Equity

The value of equity can change depending on several variables. There are two main ways it can vary: monetary and ownership. Knowing the value of your equity can help you secure more investments and know exactly how much of your business you’re giving away.

Terms That Reduce the Monetary Value of Shares

- Liquidation Preference: This gives shareholders first dibs during liquidity. They’ll get their money before anyone else which, if there is a liquidation preference of higher than 1x, can lead to some shareholders missing out when the company is sold or liquidated.

- Participation Rights: Allows shareholders to act like common stock while keeping preferential terms – it’s the best case scenario for most shareholders. Usually, participation rights include a cap which lets shareholders receive benefits and participate as common stock.

- Cash Dividends: The most common way shareholders receive cumulative dividends. They act as a form of interest with set terms for how much is accrued during a shareholder term.

Terms That Reduce Ownership Percentage

- Number of Shares: The more shares a shareholder has, the more of the company they own. Companies with lots of shares and, therefore, lots of shareholders, find themselves having to please a lot more people.

- Conversion Rates to Common Stock: Applies when preferred stock is exchanged for common stock during a distribution event. It allows shareholders to convert their shares at a multiplied rate.

- PIK Dividends: Payment-in-Kind is the other form of cumulative dividend along with cash. Unlike cash dividends, PIK dividends increase shares over time.

- Anti-Dilution: Acts as a cap that prevents shares from being diluted past a certain point. It’s beneficial to shareholders because it means the company won’t go through future rounds of fundraising where the price per share is lower than the original price they paid.

Common Stock vs. Preferred Stock

The biggest difference between common stock and preferred stock is that preferred stock comes with added rights. This makes it more appropriate for investors who have negotiated advantages, while common stock is often given to founders and employees.

Shareholders with preferred stock can negotiate certain terms that will either directly convert their shares into common stock or let them participate with common stock without giving up any of their preferred rights.

How to Manage Equity Dilution

Implementing equity dilution can be a scary time for founders, especially if it’s not handled correctly. It can quickly snowball out of control and, before you know it, you’ve only got 40% of the company you created left.

Equity Dilution Mistakes to Avoid

Raising more capital than you need.

Founders must be cautious when it comes to funding rounds, oftentimes trapped under the assumption that a larger funding round seems like a mark of success or the key to unlocking growth as an early-stage company. While raising a lot of cash may help your company grow, raising more capital than you need may lead to inefficient spending and distraction away from your business strategy.

Forgetting About Your Capitalization Table

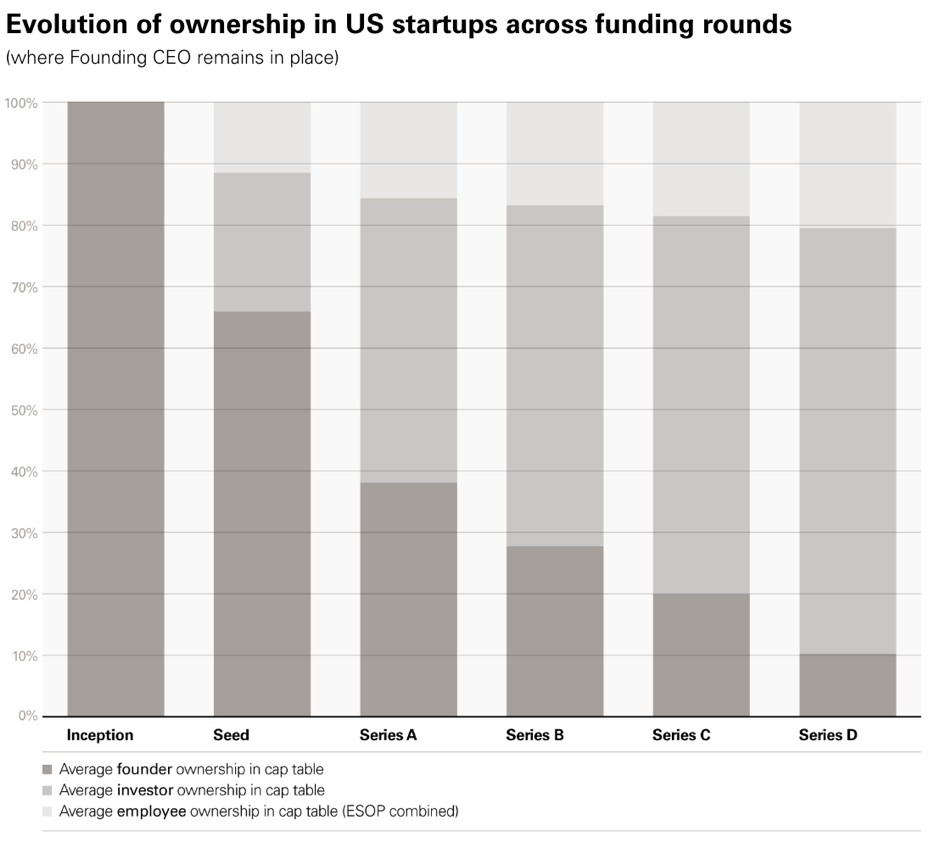

A capitalization table shows the number of shares and the ownership percentage of all shareholders in a company. It can be used as a useful tool when managing your ownership in a growing company.

There are different ways to use a cap table to help answer specific questions, such as modeling out how different funding options may impact the dilution of existing shareholders and profits per share. Alternatively, it can be used to model the impact of a succession of future funding rounds to lead overall business plans and identify possible exit scenarios.

Ignoring Investors’ Criteria

Almost every investor will have a set of outlines that help them identify the kinds of companies and deals they are looking for. Do they specialize in Series A-B? Do their deals always consist of owning 20%+ of the company? Figuring out each investors’ criteria can help find the right one that will match your business goals.

Not Researching Other Financing Options

Fundraising does not have to mean giving up a significant portion of equity ownership. Other options may include venture debt or revenue-based financing that offers growth capital while minimizing equity dilution.

Forgetting to Focus on Your Business

A clear business plan and realistic numbers should be the minimum requirement while pitching to investors in a way that minimizes dilution. A compelling pitch could attract competing investors, which gives you the opportunity to get a better valuation, potentially raise more money (if appropriate), and reduce dilution.

Keep an eye on your cap table, which might look something like this. Source.

How to Make the Most of Equity Dilution

- Calculate the amount of money you need to reach your next growth milestone

- Find investors who share your business goals and who you trust

- Review your capitalization tables regularly

- Review employee contracts when you’re in the clear

How to Prevent Equity Dilution

Equity dilution often seems like the only way forward, but that’s simply not the case. There are other options founders can access if they want to fundraise without giving away a portion of their business.

Venture Debt

Venture debt is best raised alongside or immediately following an equity round and allows startups to bridge the gap to their next milestone. While most venture debt deals come with warrants, the dilution associated with exercised warrants are significantly lower than that of an equity raise. Coupled with no board seats, venture debt allows founders to maintain control and ownership of their companies.

Find out more about venture debt in our Founder’s Guide.

Revenue-Based Financing

Revenue-based financing is another debt structure that is a good option for companies that are experiencing extremely rapid growth. Instead of offering equity, investor returns are in the form of monthly payments that are based on a percentage of the company’s monthly revenue.

Find out more about revenue-based financing in our Founder’s Guide.

Do Your Research

It’s worth educating yourself on the pros and cons of equity dilution before jumping in head first. A lot of founders believe it’s the only way they can raise money quickly, but that’s not always the case. In fact, there are several other ways you can secure funding without handing over percentages of your company.