If you had to guess: out of every $100 of venture capital funding, how much goes to companies with at least one female founder? Twenty dollars? Ten? Five?

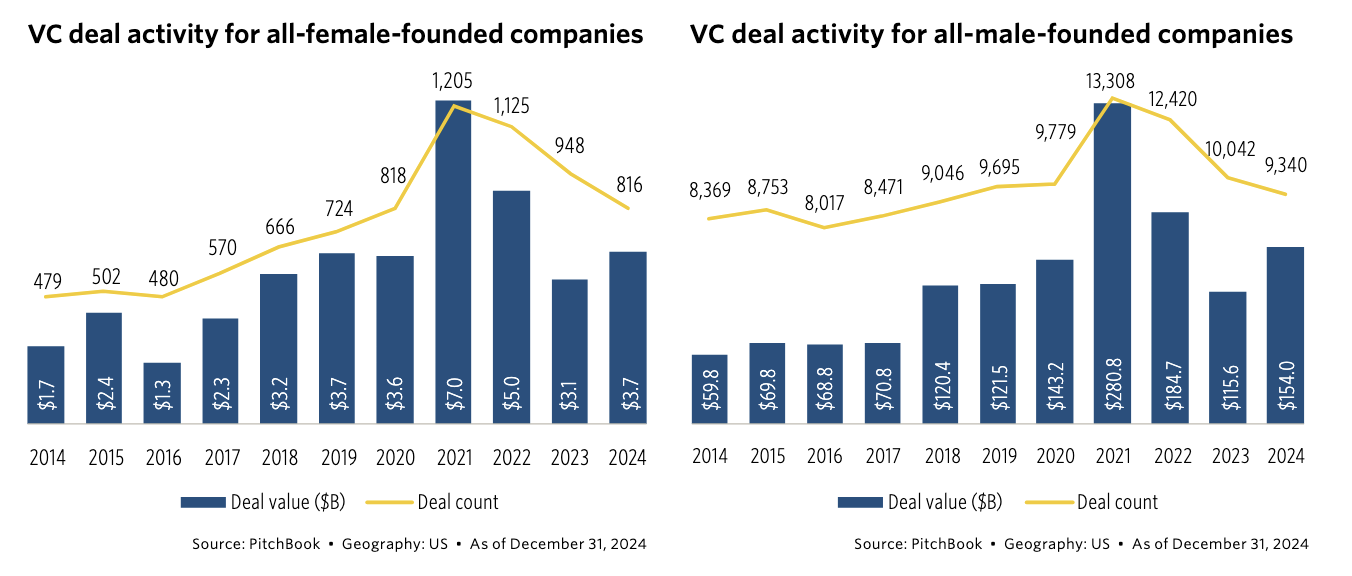

In reality, female-founded companies (including mixed-gender teams) captured about 20% of U.S. venture deal activity in 2024, roughly $38B across 816 deals (PitchBook).

But when you look at startups with all-female founding teams, the picture changes dramatically: they raised just 2–3% of total VC dollars.

This gap isn’t about ability or ambition, it’s about how capital gets allocated, and the biases built into the pitch process.

Studies show investors unconsciously treat male and female founders differently:

The system is tilted toward a specific pattern of founder, with women facing a higher burden to prove themselves and often walking away with smaller checks.

This funding bias has a ripple effect. When women-led companies are underfunded, they have fewer resources to grow, hire, and create opportunities for other women, contributing to a "leaky pipeline" in leadership.

According to McKinsey's 2023 Women in the Workplace report, for every 100 men promoted from an entry-level role to manager, only 87 women receive the same promotion.

Fewer female leaders means fewer mentors, sponsors, and decision-makers who can champion a more inclusive culture. Companies miss out, too. Research consistently shows that businesses with strong female representation at the executive level are often more profitable and have healthier cultures.

If the traditional VC model is wired with bias, what’s the alternative? The answer is performance-based financing.

Unlike venture capital, which bets on a future story, alternative funding models like venture debt focus on your company's actual performance. This approach removes much of the subjectivity that creates investor bias against female founders.

Instead of judging your pitch, lenders look at your metrics. Here’s what they typically review:

By focusing on data, lenders invest based on the health of the business, not the gender of the founder. This data-first process naturally levels the playing field. In fact, funds that use a pitch-less, data-driven model invest in 8 to 12 times more women-led companies than the industry average, even without a specific mandate to do so.

Change doesn’t happen by accident. Founders, investors, and executives all have a role to play in reducing bias and backing female leaders.

Here are practical resources:

Being intentional about how we evaluate founders, how we sponsor women into leadership, and how we design funding processes creates better companies and stronger returns.

1. Are women getting more venture funding now than before?

Yes, but progress is uneven. Over the last decade, female-founded companies have grown faster in deal count than male-founded startups, but their share of total dollars raised still lags at under 20%.

2. Should I still bother with VCs if the system is tough?

Venture capital is still critical for big, market-defining plays. But performance-based options like venture debt and revenue-based financing are powerful alternatives that don’t hinge on pitching style or pattern recognition.

3. Where do women founders see the most traction?

SaaS, healthcare, and consumer goods. These sectors have consistently seen higher representation of women-led deals. In personal products and food, women already lead more than half of all US VC deal counts.